All Categories

Featured

Table of Contents

The are whole life insurance policy and universal life insurance policy. expands money value at an ensured rate of interest and additionally through non-guaranteed rewards. grows money value at a fixed or variable price, depending upon the insurance company and policy terms. The money value is not included to the death benefit. Money value is an attribute you make the most of while active.

The plan car loan passion rate is 6%. Going this route, the interest he pays goes back into his plan's cash value rather of an economic organization.

Infinite Bank Statement

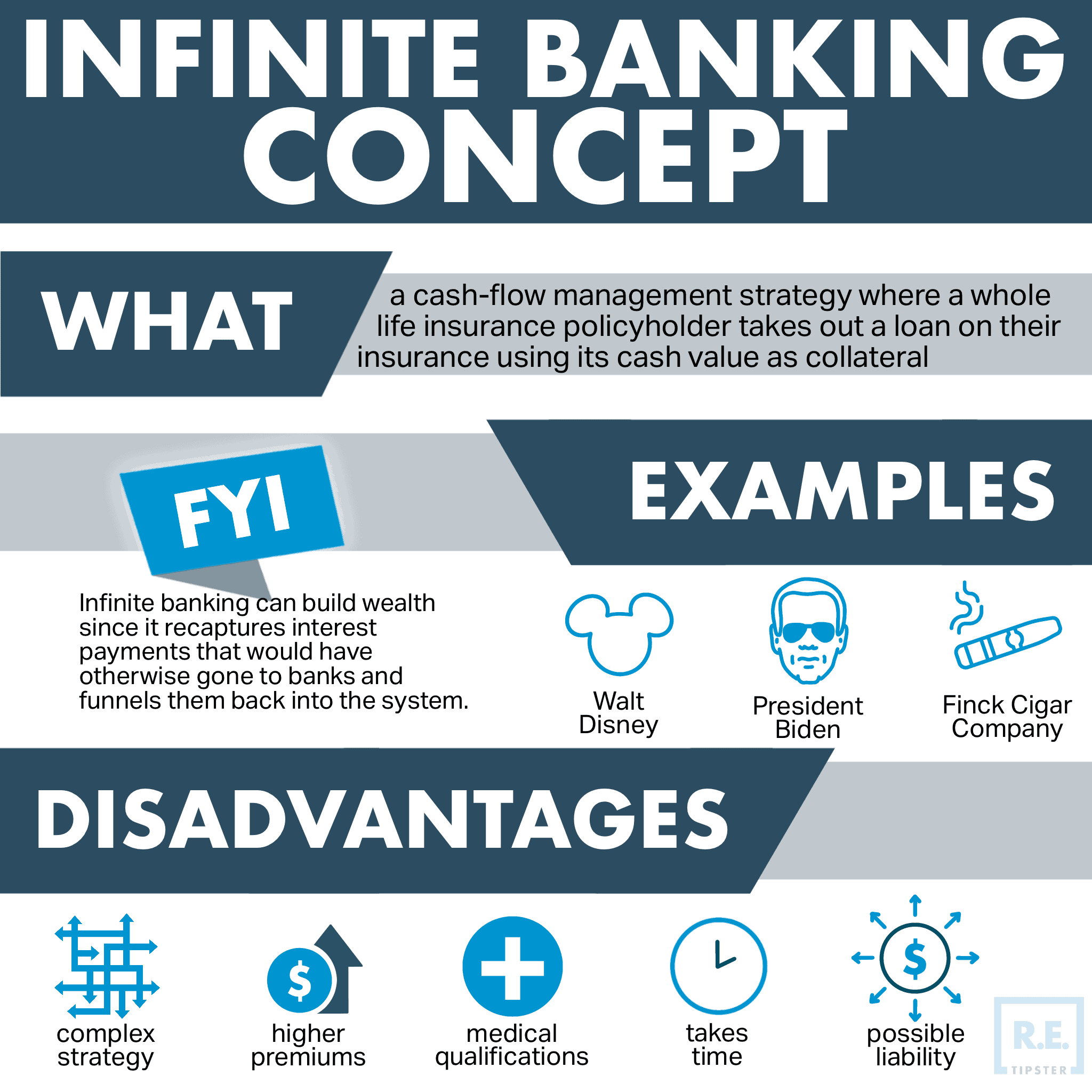

The concept of Infinite Banking was produced by Nelson Nash in the 1980s. Nash was a financing expert and fan of the Austrian college of business economics, which promotes that the worth of products aren't clearly the result of standard financial frameworks like supply and demand. Rather, individuals value cash and goods differently based on their economic standing and requirements.

One of the pitfalls of typical financial, according to Nash, was high-interest prices on lendings. Long as banks set the interest rates and car loan terms, people really did not have control over their own riches.

Infinite Financial needs you to possess your monetary future. For goal-oriented individuals, it can be the most effective financial tool ever before. Here are the benefits of Infinite Financial: Perhaps the solitary most beneficial aspect of Infinite Financial is that it boosts your capital. You don't require to undergo the hoops of a typical financial institution to obtain a lending; simply demand a plan funding from your life insurance policy company and funds will be made available to you.

Dividend-paying whole life insurance policy is extremely reduced threat and supplies you, the policyholder, a large amount of control. The control that Infinite Financial supplies can best be grouped into 2 classifications: tax advantages and property protections - infinite banking concept scam. One of the factors entire life insurance policy is optimal for Infinite Banking is exactly how it's exhausted.

Infinite Banking Concept Pdf

When you utilize whole life insurance policy for Infinite Banking, you enter right into an exclusive agreement between you and your insurance policy company. These protections might vary from state to state, they can consist of defense from possession searches and seizures, protection from judgements and defense from creditors.

Entire life insurance coverage policies are non-correlated possessions. This is why they function so well as the economic foundation of Infinite Financial. Regardless of what takes place in the market (stock, actual estate, or otherwise), your insurance coverage plan preserves its well worth.

Whole life insurance is that third bucket. Not only is the price of return on your entire life insurance policy assured, your fatality benefit and costs are likewise guaranteed.

This framework lines up perfectly with the concepts of the Continuous Riches Method. Infinite Financial interest those looking for higher economic control. Here are its main benefits: Liquidity and availability: Plan financings supply instant accessibility to funds without the limitations of conventional bank finances. Tax obligation efficiency: The cash value grows tax-deferred, and plan loans are tax-free, making it a tax-efficient device for developing riches.

Bioshock Infinite Bank Cipher Code Book

Possession defense: In lots of states, the cash money value of life insurance policy is secured from financial institutions, including an extra layer of economic protection. While Infinite Banking has its values, it isn't a one-size-fits-all solution, and it includes substantial downsides. Right here's why it may not be the very best approach: Infinite Banking often needs complex plan structuring, which can confuse insurance holders.

Visualize never having to stress over bank financings or high rates of interest once again. What happens if you could borrow money on your terms and construct riches at the same time? That's the power of unlimited banking life insurance policy. By leveraging the cash money worth of entire life insurance policy IUL plans, you can expand your riches and obtain cash without depending on traditional financial institutions.

There's no set car loan term, and you have the liberty to pick the payment routine, which can be as leisurely as repaying the lending at the time of fatality. This versatility expands to the servicing of the fundings, where you can select interest-only settlements, keeping the finance equilibrium level and workable.

Holding cash in an IUL dealt with account being credited rate of interest can commonly be better than holding the cash on down payment at a bank.: You have actually always desired for opening your own pastry shop. You can borrow from your IUL plan to cover the first expenditures of leasing a room, acquiring devices, and employing team.

Bioshock Infinite Bank Cipher Book

Individual finances can be obtained from traditional financial institutions and credit rating unions. Borrowing money on a credit card is generally really costly with yearly percent rates of interest (APR) typically reaching 20% to 30% or even more a year.

The tax obligation treatment of plan finances can vary significantly depending on your country of home and the specific terms of your IUL plan. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy lendings are typically tax-free, providing a significant benefit. In other jurisdictions, there may be tax obligation effects to take into consideration, such as possible tax obligations on the finance.

Term life insurance policy only supplies a fatality advantage, without any type of cash worth buildup. This means there's no cash money worth to obtain versus. This write-up is authored by Carlton Crabbe, President of Capital for Life, an expert in giving indexed universal life insurance accounts. The information supplied in this write-up is for academic and informational purposes just and ought to not be taken as monetary or financial investment recommendations.

For loan police officers, the extensive laws imposed by the CFPB can be seen as troublesome and restrictive. Initially, car loan policemans typically argue that the CFPB's policies develop unnecessary red tape, resulting in more paperwork and slower lending handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) needs, while targeted at shielding consumers, can result in hold-ups in closing deals and boosted operational costs.

Latest Posts

Infinite Banking Concept Reviews

How To Become Your Own Bank

Infinite Family Banking