All Categories

Featured

Table of Contents

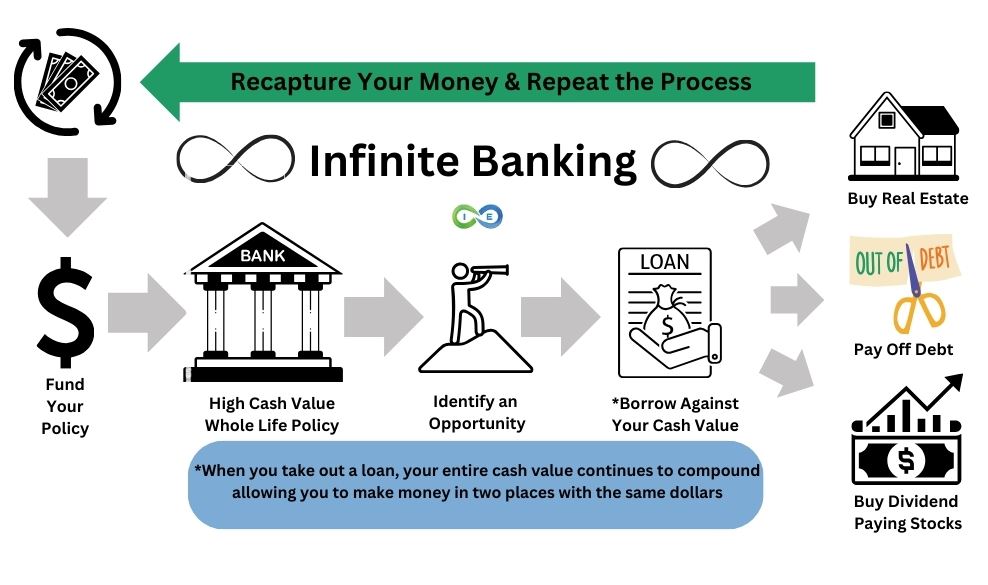

Okay, to be fair you're actually "financial with an insurance provider" instead of "financial on yourself", yet that idea is not as very easy to market. Why the term "boundless" financial? The concept is to have your money operating in several areas at the same time, instead of in a solitary area. It's a little bit like the idea of buying a residence with cash, then borrowing against your home and putting the cash to function in an additional investment.

Some people like to chat concerning the "speed of cash", which basically indicates the same point. In truth, you are simply making the most of leverage, which functions, but, obviously, functions both ways. Honestly, every one of these terms are frauds, as you will certainly see listed below. That does not suggest there is nothing worthwhile to this concept once you obtain past the advertising and marketing.

The entire life insurance coverage market is afflicted by overly expensive insurance coverage, substantial payments, dubious sales techniques, low rates of return, and poorly informed clients and salesmen. But if you intend to "Bank on Yourself", you're going to have to fall to this industry and really get entire life insurance policy. There is no alternative.

The guarantees fundamental in this item are vital to its feature. You can obtain versus the majority of sorts of cash worth life insurance policy, however you should not "financial institution" with them. As you get an entire life insurance policy policy to "bank" with, bear in mind that this is a totally different area of your economic plan from the life insurance section.

As you will certainly see below, your "Infinite Banking" policy truly is not going to dependably provide this important monetary function. One more problem with the reality that IB/BOY/LEAP counts, at its core, on a whole life policy is that it can make buying a plan problematic for numerous of those interested in doing so.

Chris Naugle Infinite Banking

Hazardous leisure activities such as diving, rock climbing, sky diving, or flying also do not blend well with life insurance items. The IB/BOY/LEAP advocates (salespeople?) have a workaround for youbuy the plan on a person else! That might work out great, since the factor of the policy is not the survivor benefit, yet bear in mind that getting a plan on minor kids is much more pricey than it should be considering that they are generally underwritten at a "common" price instead than a chosen one.

A lot of plans are structured to do a couple of points. The majority of generally, policies are structured to take full advantage of the commission to the representative offering it. Cynical? Yes. Yet it's the reality. The commission on an entire life insurance policy policy is 50-110% of the initial year's costs. In some cases plans are structured to optimize the fatality advantage for the premiums paid.

The rate of return on the policy is very vital. One of the best means to make the most of that element is to obtain as much cash as possible into the plan.

The most effective method to boost the rate of return of a policy is to have a relatively little "base plan", and after that put even more cash money right into it with "paid-up additions". Rather than asking "Exactly how little can I place in to obtain a certain survivor benefit?" the question becomes "How a lot can I legitimately took into the plan?" With even more money in the policy, there is even more cash value left after the expenses of the death advantage are paid.

An extra benefit of a paid-up addition over a regular costs is that the payment price is lower (like 3-4% as opposed to 50-110%) on paid-up additions than the base policy. The much less you pay in payment, the higher your price of return. The rate of return on your cash money worth is still going to be negative for a while, like all money value insurance coverage.

It is not interest-free. As a matter of fact, it may set you back as high as 8%. A lot of insurer only offer "straight recognition" loans. With a direct acknowledgment finance, if you obtain out $50K, the returns rate related to the cash worth yearly only relates to the $150K left in the plan.

Infinitive Power Bank

With a non-direct recognition finance, the business still pays the same reward, whether you have actually "obtained the money out" (practically versus) the policy or not. Crazy? That recognizes?

The business do not have a source of magic free money, so what they provide in one area in the plan need to be taken from one more location. If it is taken from a feature you care less about and put into a function you care extra around, that is a great point for you.

There is one even more essential attribute, normally called "laundry financings". While it is terrific to still have dividends paid on cash you have secured of the plan, you still have to pay interest on that particular lending. If the dividend rate is 4% and the lending is charging 8%, you're not precisely appearing ahead.

With a wash car loan, your financing rates of interest is the exact same as the reward price on the policy. So while you are paying 5% interest on the car loan, that rate of interest is entirely countered by the 5% reward on the funding. In that regard, it acts just like you withdrew the cash from a financial institution account.

5%-5% = 0%-0%. Same very same. Hence, you are currently "banking on yourself." Without all three of these elements, this plan merely is not going to work really well for IB/BOY/LEAP. The largest issue with IB/BOY/LEAP is individuals pushing it. Almost all of them stand to make money from you getting into this idea.

Actually, there are lots of insurance representatives speaking about IB/BOY/LEAP as a function of entire life who are not actually offering plans with the needed functions to do it! The trouble is that those who understand the principle best have a large problem of interest and usually pump up the benefits of the idea (and the underlying policy).

Infinite Banking Think Tank

You should compare borrowing against your policy to withdrawing money from your interest-bearing account. Return to the beginning. When you have absolutely nothing. No cash in the financial institution. No money in financial investments. No money in money worth life insurance. You are confronted with a selection. You can put the money in the financial institution, you can spend it, or you can purchase an IB/BOY/LEAP policy.

You pay tax obligations on the rate of interest each year. You can conserve some even more money and put it back in the financial account to start to make interest once more.

When it comes time to get the watercraft, you offer the financial investment and pay tax obligations on your lengthy term resources gains. You can save some even more cash and acquire some more investments.

The cash money worth not made use of to pay for insurance coverage and commissions expands for many years at the dividend price without tax obligation drag. It begins with adverse returns, yet with any luck by year 5 approximately has actually broken even and is growing at the dividend rate. When you most likely to buy the boat, you obtain against the policy tax-free.

Infinite Banking Definition

As you pay it back, the cash you repaid starts growing again at the reward price. Those all work quite similarly and you can compare the after-tax prices of return. The fourth alternative, nonetheless, functions really differently. You do not conserve any cash nor buy any type of kind of investment for years.

They run your debt and provide you a car loan. You pay interest on the borrowed money to the financial institution up until the car loan is paid off. When it is repaid, you have a nearly worthless boat and no money. As you can see, that is not anything like the first 3 options.

Latest Posts

Infinite Banking Concept Reviews

How To Become Your Own Bank

Infinite Family Banking